Tax Update: Using Bill Number as Primary Reference

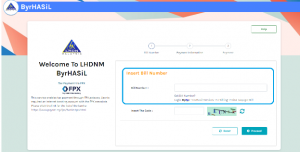

With the turn of the new year, comes with it new beginnings, and LHDN has already started the year with a system change in ByrHasil (payment function of MyTax). Starting 1 January 2023, taxpayers should get a Bill Number as their payment primary reference for making any direct tax payments (except for PCB & Stamp duties).  To get your Bill Number, you will have to use the newly introduced e-Billing function. Tax being so important, most of you are probably hesitant to explore for fear of altering something important or initiating a payment you didn’t want to settle yet. And while LHDN has made a great user manual, it is sadly only in Malay for now. Therefore, in this blog, we will introduce the core functions of e-Billing!

To get your Bill Number, you will have to use the newly introduced e-Billing function. Tax being so important, most of you are probably hesitant to explore for fear of altering something important or initiating a payment you didn’t want to settle yet. And while LHDN has made a great user manual, it is sadly only in Malay for now. Therefore, in this blog, we will introduce the core functions of e-Billing!

But before you can see the e-Billing function, you must log in to MyTax. Afterwards, drop down the ezHasil Services menu, and you will see e-Billing. Hover over it and you will find 3 options: View Bill Taxpayer, View Employer Bill, and Generate Bill.

View Bill Taxpayer

This is most relevant to everyone, as LHDN has moved all the following taxes into e-Billing:

- Tax instalment

- CP204/CP500/CP250 Tax installments

- Taxes

- Income Tax

- Real Property Gains Tax (RPGT)

- LBATA

- Penalties

- Acquirer’s RPGT

- Public entertainer tax

- Withholding Tax (WHT)

You can view all these tax bills due under the “View Bill” tab. Letter/Notice of Claim and Instalment Bills can also be viewed and settled in their own separate tabs. You can see the Bill Numbers of taxes due, however, you need not pay them separately, as you can pay them at the same time on this page.

Select the bills you wish to clear and click “Continue”. You will be redirected to a payment process page, which also displays how many bills are selected along with the total payment. After checking, “Continue” to choose your mode of payment: ByrHasil (online payment) or at a counter/agent bank.

Choosing ByrHasil will bring you to the payment process of ByrHasil (no need to re-enter Bill Number). Complete the payment and you will be redirected back to e-Billing payment process. Choosing to pay at a counter/agent bank will proceed you onwards without going to ByrHasil.

The next step is ”Payment Slip”, where you can download the slip for your future reference (remember to keep it for at least 7 years!). Those paying at a counter/agent bank must save the slip to be used as a reference when paying (hard/soft copies can do).

The final tab of the menu is “Transaction Record”, where you can view & save past payment slips.

View Employer Bill

This option is the same as “View Bill Taxpayer”, except you can also view & pay Employer Bills after entering your employer number. Payment processes are the same.

Generate Bill

This option allows you to declare your Income Tax Return Form (manual) & Labuan Business Act Tax. Once the record is saved, you can pay them directly, or view them in “View Bill Taxpayer” and “View Employer Bill”.

This function is suspended until March 2023. Use e-TT to pay these taxes in the meantime.

Transitional Period

Due to the massive change, payments using Tax Identification Number (TIN) and Tax Reference Number are still acceptable until 30 June 2023.

Conclusion

That’s it for the functions of e-Billing and the legislative changes surrounding it. While it will be confusing at first, the intention of the system to streamline all tax bills into 1 system is ultimately a good one. However, advanced notice should have been given, instead of just dropping a notice on New Year’s Eve & changing the layout after the new year. Hopefully, LHDN achieves their aims with this change.

Disclaimer

All content provided on this blog is for informational purposes only. The owner of this blog makes no representations as to the accuracy or completeness of any information on this site or found by following any link on this site.

The owner will not be liable for any errors or omissions in this information nor for the availability of this information. The owner will not be liable for any losses, injuries, or damages from the display or use of this information.

References

Official statement by LHDN: https://www.hasil.gov.my/media/zi4ft0xw/20221231-kenyataan-media-hasil-penggunaan-nombor-bil-sebagai-rujukan-mandatori-pembayaran-cukai.pdf

User Manual: https://chengco.com.my/wp/wp-content/uploads/2023/01/Manual-Billing.pdf