Tax Relief – Child (I): Child Relief & Medical

Children are their parents’ greatest pride, but usually also their greatest resource sink, as childcare has never been more expensive. From baby food to children’s entertainment to higher education, each part of child raising has gotten more and more expensive, leading to lowered standards of living for either the parent or the entire family.

To alleviate some of the burden, LHDN has provided taxpayers with tax reliefs year-on-year that relate to children. In this blog, we will cover those tax relief available for 2023 so that you can plan out your expenses to maximize any tax reliefs as you see fit. This is only part 1 of this 2-part blog, so if you are looking for early childcare, education, or lifestyle, be sure to check out the other blog after reading this one!

Child Relief

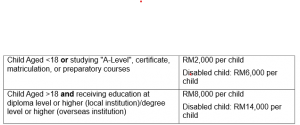

Let’s start with calculating child relief, which is the special category of tax relief given to parents/guardians. The rate of each category is given as follows:

To calculate total child relief available, check which child is eligible for what category, and total them. Remember to provide a copy of the enrolment letter of children in higher education to your employer (if you are paying MTD) and to keep one for your own records (which must be maintained for 7 years).

Do note there is a limitation to child relief if any child ends their education and starts working full-time. In the year that they end their academics, the parent is still allowed to claim child relief, but if the child’s earnings for the year exceed total child relief available for the parent, then that child is no longer eligible for claiming child relief.

An example to illustrate this: Tom has 2 children, the elder was studying at a university during the start of the year, while the younger was below the age of 18. During the year, the elder child graduated and started working, earning RM 11k during the year. The parent’s total child relief is RM10k (RM8k+RM2k), but as the elder child earned more than the total, only RM2k child relief is available to the parent for the year.

Medical

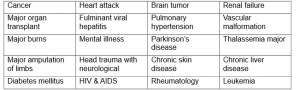

Let’s look at medical reliefs. Within this category is RM10k of possible tax relief. The 1st class of medical tax relief available is for serious diseases. It covers treatments for the following:

This notably includes mental illnesses, so please do not neglect your child’s mental health!

A new category of medical tax reliefs introduced during 2023 is intervention expenditure for the following mental disabilities:

- Autism

- Attention Deficit Hyperactivity Disorder (ADHD)

- Global Developmental Delay (GDD)

- Intellectual Disability

- Down Syndrome

- Specific Learning Disabilities

This new category of medical tax relief is limited to RM4,000 in 2023, which is included in the overall medical tax relief limit of RM10k.

Other categories available for your child’s medical expenses are vaccinations, and medical examinations (which includes complete medical checkup, mental health consultation & COVID-19 testkits/lab tests). Each of these are restricted to RM1k per category, but the overall medical relief cannot exceed RM10k. This means if, unfortunately, you incurred serious disease expenses of RM10k or above, you cannot claim any further tax relief on any of the above-mentioned expenses.

Should you buy any basic supporting equipment for your disabled child, you may claim up to RM6k for those expenses.

If you have additional funds, it is also highly recommended that you purchase medical insurance for your child as they can lessen the burden of rising medical costs. This category of insurance is shared with education insurance & your own/spouse’s medical insurance and is restricted to RM3k, so plan accordingly based on your needs and abilities.

Reminder to always keep any receipts/statements that are used for tax relief claim well, either hardcopy or softcopy, for 7 years minimum. Tax reliefs also do not extend their cap when jointly assessed, so plan & calculate if joint assessment or separate assessment is more tax efficient.

Conclusion

While the tax reliefs provide a much aid to those who can utilize it, it does not really solve the financial difficulties of raising a family in the current age. Prices are rising exponentially while most people see their wages not keeping up with inflation at all. Families that are struggling probably don’t make enough income to utilize the full extent of these reliefs either. For those families, we implore you to look for government initiatives such as Sumbangan Tunai Rahmah (STR) to aid your situation.

With that, covers part 1 of our 2-part blog on tax relief derived from children. Look out for part 2 of this topic, where we cover early childcare, education & lifestyle expenses.

Disclaimer

All content provided on this blog is for informational purposes only. The owner of this blog makes no representations as to the accuracy or completeness of any information on this site or found by following any link on this site.

The owner will not be liable for any errors or omissions in this information nor for the availability of this information. The owner will not be liable for any losses, injuries, or damages from the display or use of this information.

References

LHDN’s list of tax reliefs: https://www.hasil.gov.my/en/individual/individual-life-cycle/how-to-declare-income/tax-reliefs/

Belanjawan 2023 Tax Measures (Appendix 2): https://budget.mof.gov.my/pdf/belanjawan2023/ucapan/tax-measure.pdf

Sumbangan Tunai Rahmah (STR): https://bantuantunai.hasil.gov.my/